Blog / Bookkeeper vs. Payroll Administrator: Key Skills & Duties

Bookkeeper vs. Payroll Administrator: Key Skills & Duties

Accounting, Tax, and Payroll Diploma

- Accounting Assistant/Technician

- Bookkeeper

- Income Tax Return Preparer

- Payroll Administrator

Table of Contents

In accounting, both bookkeepers and payroll administrators are vital, but their responsibilities differ. Bookkeepers track financial transactions, whereas payroll administrators manage pay and deductions for employees.

While both roles are essential to a company’s financial operations, each requires its own specialized knowledge and skills. At Sundance College, our Accounting, Tax & Payroll diploma program prepares you for both paths, equipping you with the hands-on training and industry-relevant knowledge to start a career in both roles.

Listen to: Bookkeeper vs. Payroll Administrator: Key Skills & Duties

What Does a Bookkeeper Do?

A bookkeeper is an accounting professional that’s directly responsible for recording and organizing all of a company’s financial data. Larry G., an instructor for Sundance College’s Accounting, Tax, and Payroll diploma program, explains:

“Bookkeepers focus more on daily recordkeeping to help provide businesses with a reliable picture of their financial health at any time.”

With up-to-date financial data on hand, bookkeeping aids businesses in catching any errors early on and making more informed financial decisions swiftly.

Financial Data Recording & Organizing

As a bookkeeper, you’ll focus on data entry by making sure every sale, purchase, or payment is accurately logged into ledgers with details such as the date, amount, purpose, and the bank account involved. Using accounting systems like QuickBooks, you’ll organize and manage all this financial information in one place. With all records up to date, you’ll provide businesses with an accurate picture of their financial health.

Income & Expense Tracking

To keep financial data accurate and up to date, you’ll need to be proficient in income tracking and expense tracking. You’ll monitor all money coming into the business (income) and all outgoing payments (expenses). This ongoing process helps you monitor cash flow and quickly identify trends or discrepancies in a business’s finances.

Compliance & Financial Reporting

Using the data from your ledgers, you’ll prepare regular financial statements, such as income and cash flow statements. Then, you’ll compare the business’s bank statement to your ledger. If there’s a discrepancy in your financial reporting, you’ll investigate and adjust your records to maintain both accuracy and tax compliance.

Essential Bookkeeping Skills

You’ll need sharp attention to detail to catch every number and keep the ledgers accurate. Software proficiency in a tool like QuickBooks will be key, so you can breeze through data entry and reporting. Having good organization skills will help in compiling financial data so you can reference information when needed.

What Does a Payroll Administrator Do?

As a payroll administrator, you’ll maintain payroll compliance by making sure employee compensation is received accurately and on time. Instructor, Larry G., emphasizes:

“No one notices payroll when it’s done right, but they sure do when it’s not. That’s why this role matters.”

A payroll administrator can impact legal compliance, employee trust and retention, and even data protection in a business, making them, too, an impactful and important role to any business. See what you’ll need to do to make sure payroll processes are done right:

Employee Compensation & Deductions

At the end of each pay period, you’ll handle wage calculation for salaries, overtime, and bonuses while taking out taxes and insurance deductions correctly. Before final pay is processed, all these must be accounted for properly and promptly.

Payroll System Maintenance & Tax Compliance

Using payroll software like QuickBooks, you’ll stay on top of payroll system maintenance by making sure employee records are updated regularly to reflect new hires, terminations, or changes in status. On top of that, you’ll need to stay current with changing tax laws, so all tax filings are accurate and submitted on time. This helps you avoid penalties and stay compliant with the latest regulations.

Accurate Payment & Reporting

Whether you’re preparing physical paychecks or direct deposits, maintaining accuracy with payments is non-negotiable. You’ll review payroll records and create reports, so management and government agencies get accurate, up-to-date information. All of this is part of making sure every payment matches records and payroll compliance standards.

Essential Payroll Skills

Being responsible for payroll means you’ll need to know how to maintain confidentiality to protect employee data. You’ll also need solid regulatory knowledge to keep up with changing tax and labour laws, and high attention to detail to make sure accuracy is upheld to avoid costly errors. Communication skills are important for answering employee payroll questions and collaborating with HR and finance teams.

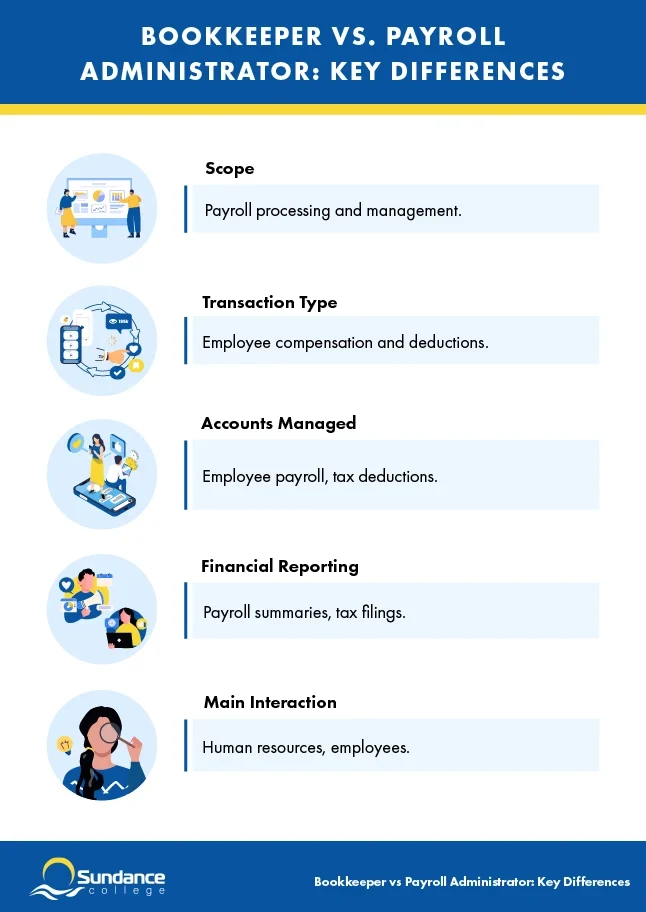

Key Differences: Bookkeeper vs Payroll Administrator

Bookkeepers and payroll administrators support businesses in different but equally essential ways. To understand their differences, here is a role comparison table that shows the unique job duties of each.

Bookkeeping vs Payroll Comparison

While the focus and responsibilities differ, both bookkeeping and payroll administration are essential to a company’s financial operations. Sundance College’s Accounting, Tax, and Payroll diploma program trains you in both areas, so you are prepared to meet the demands of today’s finance teams and have a positive impact on businesses.

Career Progression for Bookkeepers and Payroll Administrators

With the right training, both bookkeepers and payroll administrators can find opportunities that will lead to career progression.

Whether you’re looking to upskill and climb the corporate ladder in the accounting department, or offer your skills as a freelance worker, your diploma program training will prepare you to take on a number of different bookkeeping or payroll administration roles:

Bookkeeper Career

Every business relies on someone who turns transactions into clear records and helps teams understand their finances. Here are a few bookkeeping roles where the skills, knowledge, and hands-on experience from your college diploma in Accounting, Tax and Payroll will help you stand out:

- Accountant Assistant/Technician: Foundational position in accounting.

- Junior Accountant/Bookkeeper: Handles general financial data.

- Income Tax Preparer: Focuses on tax compliance.

- Invoicing & Billings Clerk: Handles accounts receivable/payable.

- Inventory Assistant: Mainly responsible for inventory accounting.

Payroll Career

In payroll you play a key role in making sure employees are paid accurately and on time. You can become a payroll administrator as soon as you graduate from an Accounting, Tax, and Payroll diploma program. You can also move into other entry-level payroll positions, including payroll coordinator, payroll clerk, and payroll assistant.

Your skills, knowledge, and industry experience in payroll will help you stand out among other job seekers in finance.

Why Choose Sundance College for Accounting, Tax & Payroll?

Sundance College’s Accounting, Tax & Payroll diploma program is designed to prepare you for two of the most in-demand roles in finance: bookkeeping and payroll administration. No matter which financial role you choose to pursue, you’ll graduate with the training to step into either path or take on positions that require a blend of both.

The diploma includes hands-on learning in financial accounting, payroll processing, tax preparation, QuickBooks, Microsoft Office, and business communication. You’ll build skills that align with what employers need, including managing ledgers and processing pay.

To help you apply what you’ve learned, the program includes a five-week practicum in a business setting. This experience gives you the chance to build confidence, strengthen your resume, and start making connections before graduation.

With a student-first approach to education, you’ll take one course at a time, get direct support from instructors, and have lifetime access to our Career Services team for resume help and mock interviews. From the moment you enroll to when you’ve landed your financial career, Sundance College is here to support you at every stage.

The first step towards a new career in an in-demand field like finance is to chat with an admissions advisor. They’ll help you explore all bookkeeping, payroll administration, and tax careers available to you after graduation, and help you find the program that will best fit your career goals.

Both bookkeepers and payroll administrators are essential to businesses in their own way. To help you build the skills needed for either career path, Sundance College offers a career-focused diploma program that will prepare you for success as a bookkeeper or payroll administrator!

Bookkeeping and Payroll FAQs

-

Can a bookkeeper do payroll?

Yes, in some organizations bookkeepers take care of payroll when needed.

-

Do I need different training for each role?

With Sundance College’s Accounting, Tax, & Payroll diploma, you’re able to learn the skills and knowledge needed for both roles.

-

Which role is more in demand in Canada?

Both roles are equally in demand across Canada.

-

What software do bookkeepers and payroll administrators use?

Both bookkeepers and payroll administrators commonly use QuickBooks. It’s an industry-standard accounting software that helps manage financial records, process payroll, generate reports, and stay organized. Sundance College’s program includes hands-on training with QuickBooks, so you can graduate ready to use the same tools employers rely on.

-

Is payroll part of accounting or separate?

Payroll is considered a specialized area within accounting because it involves using core accounting skills and is closely tied to overall financial management.

-

Which role pays more?

Salary depends on several factors, including your experience, location, and the type of company you work for. Both bookkeeping and payroll administration offer strong earning potential, especially as you build your skills and take on more responsibility. With training in both areas, you can qualify for a wider range of opportunities.

Related Blogs

Subscribe for more career advice

Blog Categories

Share on: