Blog / Taking a Career Focused Look at Accounting, Tax, and Payroll Diplomas

Taking a Career Focused Look at Accounting, Tax, and Payroll Diplomas

Accounting, Tax, and Payroll Diploma

- Accounting Assistant/Technician

- Bookkeeper

- Income Tax Return Preparer

- Payroll Administrator

Table of Contents

There are many reasons why people choose Accounting, Tax & Payroll programs as their path to a brighter future. Many candidates enjoy working with numbers and applying their organizational skills in addition to the stability, high demand, and competitive wages.

So, how can you start your career in the financial field?

In this article, we answer the most common questions about beginning a career in the accounting, tax, and payroll workforce: the main advantages of this sector, which career paths you can pursue with a diploma, the average salaries associated with these positions across Canada, how to pick the best college program for you, and employment trends.

Three Key Reasons to Study Accounting, Tax, and Payroll

In today’s world, the power of language proficiency is undeniable. It’s essential to effective communication, information processing, persuasion, problem-solving, and much more.

Warren Buffet once emphasized, “Accounting is the language of business”. To achieve success in the realm of business, fluency in this language is essential. The rewards that come with mastering skills associated with accounting, tax, and payroll are extensive.

Now, let’s focus on three key benefits of starting a career in accounting, tax, and payroll:

1. Your Profession Will Always Be Relevant And In Demand

If you are skilled in accounting, tax, and payroll, you’re unlikely to be out of a job. In fact, the unemployment rate for these professions is half that of others. In 2023, Canada’s overall unemployment rate is 5.2%. In comparison, there is only a 2.5% unemployment rate for accounting and financial professionals which indicates high demand for skilled people to fill positions in these fields.

Furthermore, the demand for bookkeepers, accounting assistants, and payroll administrators exceeds the supply, according to the Government Job Bank of Canada. In the next decade, there are expected to be:

- 116,800 bookkeeping job openings with only 108,000 candidates to fill them

- 57,600 accounting assistant job openings with only 51,000 candidates to fill them

- 23,100 payroll job openings with 22,600 candidates to fill them

2. There Are Numerous And Varied Opportunities

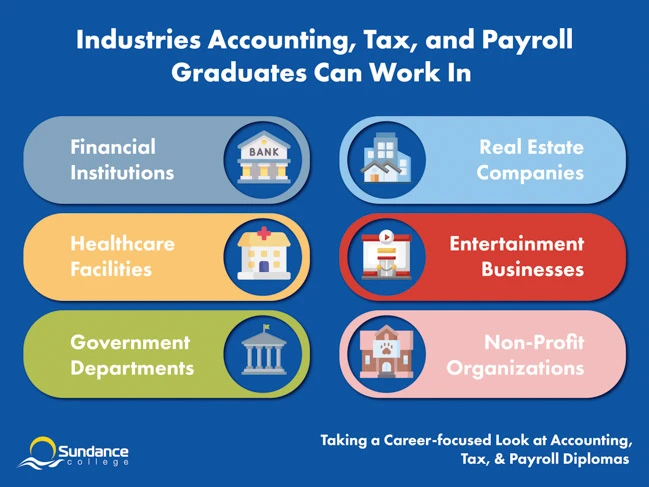

One of the greatest advantages of studying accounting, tax, and payroll is the versatility it offers. There are two key areas of versatility: sector options and position options.

Every sector – whether public, private, or non-profit – relies on staff with accounting skills to run payroll, pay taxes, and manage finances, making your ATP diploma valuable across a wide range of career opportunities. Here are some examples of where your talents can be applied:

- Financial institutions – including banks, investment firms, law firms, and insurance companies.

- Healthcare facilities – including hospitals, clinics, nursing homes, and birth centers.

- Local, provincial, and federal government departments – For example, every Ministry (Health, Social Services, Justice, etc.) in the Government of Saskatchewan has its own payroll section.

- Real estate companies – including brokers, property management firms, and construction firms.

- Entertainment businesses – including movie studios, music labels, and tour operators.

- Non-profit organizations – including charities, foundations, healthcare organizations, educational institutions, and research institutes.

Within each of these sectors, there will be various career options, each with its own unique set of day-to-day responsibilities. Some of the most common of these career paths include:

- Accountant assistant / technician – As an accounting assistant/technician, you will provide support in handling financial statements, transactions, and records. Additionally, you will assist with payroll tasks and offer administrative support to the accounting department.

- Junior accountant / bookkeeper – In this role, you will be responsible for maintaining financial records and statements, processing transactions, conducting reconciliations, and performing basic financial analysis.

- Income tax preparer – As an income tax preparer, you will assist with tax deductions, compliance, and planning. Your role will also involve providing guidance and support related to tax matters.

- Invoicing & billings clerk – This position involves efficiently generating and processing invoices, managing accounts receivable, resolving issues, and preparing billing records and reports.

- Payroll administrator – As a payroll administrator, you will accurately process employee payroll, manage records and deductions, ensure compliance, and generate payroll reports. Additionally, you will provide support to employees regarding payroll matters.

- Inventory assistant – In this role, your responsibilities will include reviewing purchase records, maintaining databases, conducting physical counts of inventory, and reconciling actual stock counts with computer-generated reports.

- Office assistant / coordinator – As an office assistant/coordinator, you will offer administrative support for office operations. This will involve managing supplies, schedules, and communications, as well as assisting with filing, preparation, and organization of documentation.

These positions offer a range of opportunities to contribute and excel in various aspects of the professional landscape.

3. You Will Enjoy Decent Wages

Accounting, tax, and payroll careers offer attractive compensation, even at the entry level. Many individuals starting their careers in the ATP field enjoy salaries above minimum wage. The minimum wage across the provinces and territories in Canada is $15 per hour, on average, or $31,200 per year. In comparison, the average entry-level salaries for those with accounting, tax, and payroll diplomas are much higher. For example:

- If you are an accountant technician working in Calgary, Alberta, the average salary is $52,650 per year

- If you are a bookkeeper working in Montreal, Québec, the average salary is $57,178 per year

- If you are a payroll administrator working in Regina, Saskatchewan, the average salary is $70,750 per year

As you acquire more experience, along with demonstrating dedication, diligence, and consistently good performance, your compensation should adjust in line with that experience and competency.

Personal Characteristics for Success

To excel in a career in accounting, tax, and payroll, it helps to naturally possess certain personal traits and skills; however, they can also be learned. Three key traits are:

- Attention to detail: In the world of numbers, even a minor error can have significant consequences. As an accountant assistant, you must be able to focus and precisely spot discrepancies, ensure accuracy in financial records, and adhere to regulatory guidelines.

- Analytical thinking: You must have good analytical skills to scrutinize financial data, efficiently solve problems, make data-driven recommendations, and optimize financial performance.

- Integrity and ethics: As an ATP professional, you will handle sensitive financial information and be entrusted with maintaining confidentiality and upholding ethical standards. Integrity and professional ethics in accounting, tax, and payroll must be the foundation of your work, ensuring you act in the best interests of your clients and/or employers.

Of course, having strong communications skills and computer knowledge are also vital for success in the accounting, tax, and payroll workforce. You can check our article 5 Key Skills for a Career in Finance to learn more.

Choosing the Right Accounting, Tax, & Payroll Diploma Program to Kickstart Your Career

When you enter “Accounting College Diploma” into your search engine, you are flooded with numerous colleges to choose from. But how can you determine which one is the perfect fit for you? We have identified four essential criteria for you to consider, and you can discover three additional factors by exploring our article on how to choose a career college.

1. Courses And Curriculum

The accounting, tax, and payroll field is more than just technical skills; professionals in this field work closely with clients to understand their financial goals, provide advice, and deliver services. Strong soft skills such as active listening, time management, and effective communication are crucial for building long-term relationships with clients.

By combining hard skills with soft skills, accounting diplomas provide a comprehensive education that equips graduates with the technical expertise and interpersonal abilities necessary for a successful and well-rounded accounting career.

Sundance College’s CATP program is designed to teach students both hard and soft skills by offering the following courses:

- Financial Accounting

- Computerized Accounting – QuickBooks

- Personal Income Tax Preparation

- Payroll Accounting

- Operations Fundamentals

- Business Essentials

- Business Communications

- Microsoft Office Computer Skills

- Becoming a Master Student

- Communication & Interpersonal Skills

2. QUALIFIED FACULTY

In addition to the type of courses offered, who teaches the courses matters when choosing your college. Request more information about the instructors’ level of education, industry-related experience, and reviews from current students. You want to ensure your instructor is familiar with the topics and has the experience to back up the foundational knowledge.

At Sundance College, all our instructors have proven industry experience, and work closely with our students to ensure their success. For example, one of our CATP instructors, Roger Hardie, shown below, has completed an MBA (Master of Business Administration) and is now pursuing a CAPA (Certified Accounts Payable Associate) certification to better aid our students in their transition to the workforce:

“At Sundance College, we always have our students’ best interest at heart. We really do as much as we can for the students; we empower them, we enable them, and we do whatever we can to support them.”

3. Hands-On Training And Practicum Opportunities

When choosing a career college, pay attention to whether the program offers hands-on training and practicum placement, and if so, how many hours/weeks it includes.

Having a practicum on your resume is invaluable; it enhances your employability, applies your classroom knowledge to real-world scenarios, creates networking opportunities, and gives you a competitive edge against other applicants.

At Sundance College our students first establish a strong foundational knowledge and then proceed to apply that knowledge through hands-on experiences. This approach ensures that students become well-acquainted with the tools and programs they will encounter in their future careers. Roger speaks to this:

“During the 10-month program, our students do a lot of calculations to build a solid foundation to understand the logic behind accounting, tax, and payroll formulas. Students then apply their acquired knowledge in QuickBooks, one of the accounting software commonly used by Canadian companies. The program also explores the Canadian Revenue Agency website to get familiar with where and how to find information about payroll changes.”

In addition to providing hands-on learning, Sundance College’s CATP program includes a 5-week practicum in a business firm for students to gain experience and smooth transition into their new career.

4. Approach To Teaching

A College’s approach to education can significantly impact your experience. It sets the tone for how knowledge is imparted, skills are developed, and student engagement is fostered.

At Sundance College, our mission is to “support student success”. Here are key elements that set us apart:

- Development – Our programs are thoughtfully designed to not only equip you with relevant knowledge and skills for career development but also to foster competency. You focus on one course at a time rather than having to split your attention between 4or 5 unrelated topics. Concentrated immersion into one course increases knowledge retention and your academic success rate.

- Personalized Studies – We believe that each student is unique, with varying knowledge backgrounds, high school experiences, learning styles, and external commitments. That’s why our students have direct access to their instructors and the opportunity for one-on-one sessions These personalized interactions allow students to address any uncertainties, bridge individual learning gaps, and optimize their educational journey, regardless of where they currently stand. Roger further highlights, “One of the remarkable aspects of Sundance is that it doesn’t matter where you fall on the learning spectrum; we always meet you where you are.”

- Comprehensive Support – Alongside our academic programs, Sundance College offers comprehensive Career Services to support students in their professional journey. Students develop interview skills via mock interviews, have access to resources for resume preparation, and build an initial network of professionals and peers prior to entering the workforce. Roger emphasizes the transformative growth of our students, stating, “Our students grow on a trajectory. Sometimes you will not recognize somebody who started eight months ago to somebody who’s finished their capstone.”

In addition, our students have access to mental health specialists and supports. Sundance College understands that success extends beyond the classroom, and our aim is to provide the necessary resources and support to ensure your overall growth and development.

Secure Your Future with Sundance College’s Accounting, Tax, & Payroll Diploma Program

In today’s competitive job market, making the right choices is paramount to securing a successful future. The demand for accounting, tax, and payroll professionals is on the rise and the need for these professionals is ongoing.

To compete successfully in these careers, you need to acquire essential skills and knowledge. From foundational concepts to advanced topics, Sundance College’s Accounting, Tax, and Payroll Diploma program teaches the skills and expertise employers are looking for.

Enrolling in our program is a seamless process. Mike W., one of our CATP graduates, attests to the efficiency of our enrollment system:

“When I first contacted Sundance College online, to the point where I had everything in line to start my courses was a span of 4 days. And I was starting my first course the following Monday.”

For more information on how you can start your career in this diverse and in-demand field, get in touch with us today.

Related Blogs

Subscribe for more career advice

Blog Categories

Share on: