Blog / Accounting, Tax & Payroll Interview Questions and Answers

Accounting, Tax & Payroll Interview Questions and Answers

Accounting, Tax, and Payroll Diploma

- Accounting Assistant/Technician

- Bookkeeper

- Income Tax Return Preparer

- Payroll Administrator

Table of Contents

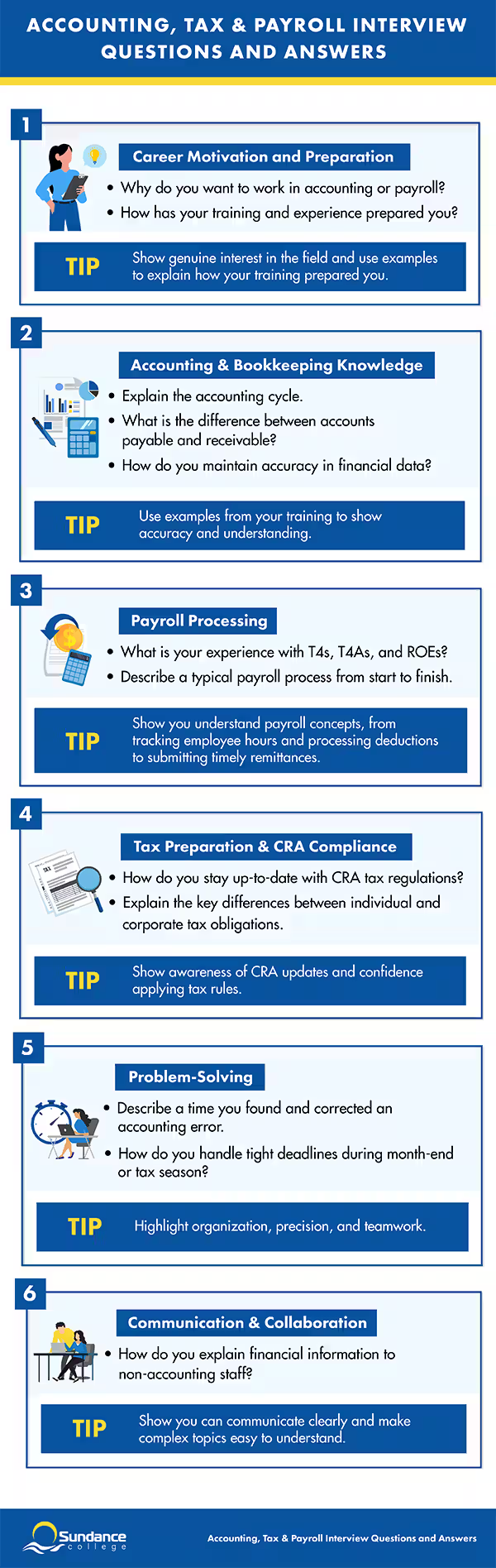

Landing an interview for an accounting role gives you a chance to show you’re capable of doing the day-to-day work. Potential employers want to hear how you approach bookkeeping, payroll, tax preparation and reporting, as well as how you stay organized and communicate effectively. When you can explain what you’ve learned and how you’ve applied those skills clearly, naturally, and with real world examples, it shows that you’re serious about this new career.

Let’s look at some of the interview questions you might be asked and how to approach them.

Questions About Career Goals & Experience

Interviewers ask about your goals to understand what’s motivating you to work in accounting in general, as well as at their organization.

Maybe you enjoy accuracy and structure in your day -to-day work, or you take satisfaction from solving problems. You might feel drawn to supporting a business you care about, keeping its finances organized, employees paid, or decisions well-supported.

Talking about what draws you to this field is often the first impression employers and hiring managers have of you – it helps employers see your enthusiasm for the field and how your background fits what they’re looking for the role.

Why do you want to work in accounting, tax, or payroll?

You’ll need to explain what makes this field meaningful to you, whether it’s solving problems through numbers, using financial details to help guide decisions, or applying structured procedures that support a business and the people who work there.

Your training for this field, from coursework, hands-on practice, or a practicum in your diploma program, gives you examples to talk about.

Sample Answer

“I’ve always been interested in how numbers tell the story of a business, revealing where it’s doing well and where it can improve. During my Accounting, Tax, and Payroll diploma program, I learned about the accounting cycle, from recording transactions and processing payroll to preparing and analyzing financial statements such as balance sheets, income statements, and cash flow reports. Each stage helped me see how accurate data guides business decisions and contributes to financial stability. That experience made me realize how much I enjoy this kind of work and want to make a career in it.”

Tip

Highlight what appeals to you about accounting, such as problem-solving, attention to detail, or the satisfaction of turning complex information into clear insights. Employers look for candidates who can apply these skills when recording, verifying, and interpreting financial information to support sound business decisions.

How has your college or practicum prepared you for this role?

Employers want someone who can show up ready. Be prepared to explain how your training prepared you for this work. Talk about the areas where you gained practical exposure, and how these skills apply to a business setting.

Sample Answer

“The training I received during my Accounting, Tax, and Payroll diploma program has prepared me in a lot of ways. I gained technical knowledge in bookkeeping, payroll management, and personal income tax preparation. I learned to use software like QuickBooks, understand payroll legislation, and handle deductions and reporting requirements.

My practicum at a medium-sized business was where I got to put these principles to use. I assisted with payroll and bookkeeping, which gave me experience working in a professional environment and prepared me to start this role today.”

Tip

Use examples from your training that demonstrate both technical ability and readiness for the workplace. If you helped manage payroll records, organized financial data, or worked alongside an accounting team during your practicum, share those experiences to show that you can use what you’ve learned in a professional setting.

Questions About Accounting & Bookkeeping Knowledge

Interviewers ask these questions to check how well you use accounting concepts in real-life situations. They’re looking for accuracy, logic, and awareness of how your work supports decision-making. Use your answers to show that you can connect classroom learning with the practical side of maintaining a company’s financial records.

Please explain the accounting cycle

To tackle this question, explain how the accounting cycle turns financial data into information a business can rely on. Use examples that show you can turn the recording and organization of transactions into reports that reveal a company’s financial performance.

Sample Answer

“During my practicum, I had the chance to work through the accounting cycle from start to finish. I helped enter daily transactions like supplier invoices, customer payments, and routine expenses, and I checked in with my supervisor if something didn’t look right. From there, I posted the entries to the ledgers and went over the trial balance with the team. I also worked on adjustments for items such as accrued expenses and prepaid amounts.

By the time we prepared the monthly statements, I could see how each stage connected. Being part of that process showed me how accurate entries and careful review keep financial information reliable.”

Tip

Accounting is not just a random set of tasks, but a roadmap to financial order and success. Focus on showing that you understand both the accounting process and its purpose.

What’s the difference between accounts payable and accounts receivable?

Use this as an opportunity to show that you understand how money moves through a business. Think about moments from your training or practicum where you worked with accounts payable and receivable, such as updating records, matching invoices, or tracking payments. How did those actions help the company?

Sample Answer

“Accounts payable refers to the money a company owes to its vendors, and accounts receivable is what customers owe to the company. During my practicum at a local accounting firm, I worked on reconciling vendor invoices and customer payments in QuickBooks. Once, I noticed a pattern of overdue customer balances that hadn’t been followed up on. I helped the team organize an updated receivables list, send reminders, and document payments once they came in. That small project improved their cash flow for the month and showed me how closely payables and receivables are tied to a company’s financial stability. It also taught me the value of catching small discrepancies early before they turn into larger issues.”

Tip

Make sure your answer clearly explains the difference between the two functions and why both are important to a company’s cash flow. Use examples from your training to make your answer stand out.

How do you ensure accuracy in your financial data?

Accuracy is what gives financial information its value, and small errors can quickly add up. To approach this question, explain how you stay attentive and thorough when working with data. Share examples from your training or practicum that show how you developed these habits.

Sample Answer

“During my practicum at a mid-sized accounting firm, I helped prepare weekly financial summaries for several small business clients. While reviewing one company’s vendor payments, I noticed a set of invoices that had been entered twice under different dates. I flagged the issue, confirmed it with the team, and corrected the entries before the month-end report went out. Catching that error saved the client from overstating their expenses for the period. That experience taught me that accuracy is more than checking numbers; it involves staying alert, questioning inconsistencies, and taking responsibility for the quality of your work.”

Tip

Highlight moments when your attention to detail made a difference. Examples that show initiative and accountability prove you understand the impact of precision in accounting.

Questions About Payroll Processing

Questions about payroll give employers an idea of how well you understand pay structures, reporting requirements, and compliance. They also reveal how comfortable you are working with employee data and meeting strict deadlines. Show them that you can process payroll accurately and follow procedures in order to build trust in your abilities.

What’s your experience working with T4s and ROEs?

Use this as an opportunity to talk about how your hands-on training gave you experience with payroll forms and reporting procedures.

Sample Answer

“During my practicum, I worked with the payroll team during a busy period leading up to year-end. I helped review employee records, confirm hours, and check deductions before the final reports were submitted. There was a lot to keep track of, but it felt rewarding knowing the work helped everyone get their documents on time. It made me appreciate how much care and teamwork go into making this process run smoothly.”

Tip

Refer to specific forms or tasks you’ve worked on and highlight your understanding of compliance.

Describe a typical payroll process from start to finish.

Payday has to be right. Use this as an opportunity to show that you understand how a payroll cycle operates, and the steps involved in completing it.

Sample Answer

“During my practicum, I supported the payroll process by reviewing employee hours, entering data into QuickBooks, and verifying deductions like CPP, EI, and income tax. After checking totals, I helped prepare pay statements and update records for reporting. Working through each stage helped me understand how organization and attention to detail keep payroll running.”

Tip

Focus on what you observed and practiced during your training and practicum.

Questions About Tax Preparation & CRA Compliance

These questions test your understanding of CRA requirements and your attention to detail when working under deadlines. They give employers insight into how you interpret regulations, organize documentation, and complete filings accurately and on time.

How do you stay up-to-date with CRA tax rules?

Use this as an opportunity to show your awareness of tax regulations and the steps you take to stay informed.

Sample Answer

“During my practicum, I worked with a team that handled a variety of tax filings for small businesses. I learned how important it is to keep up with CRA updates, especially when deadlines and deductions change. We checked the CRA website regularly, subscribed to email updates, and used tax software alerts to catch any new rules. Seeing how that attention to detail kept clients compliant taught me the value of staying proactive instead of waiting until year-end to review changes.”

Tip

Mention the tools, websites, or resources you use to stay informed, and show that you take initiative to stay current with CRA requirements.

Explain the key differences between individual and corporate tax obligations.

Use this question to demonstrate your understanding of the tax systems you studied and how they apply to different types of taxpayers.

Sample Answer

“Personal taxes focus on an individual’s income, deductions, and credits, while corporate taxes deal with a company’s income, expenses, and retained earnings. During my practicum at a local accounting firm, I saw both in action. I helped the team prepare personal returns for clients by reviewing T4s and entering deductions, and I also assisted with corporate files by checking expense records and organizing documents for T2 preparation. Comparing the two helped me understand how corporate filings involve more detailed reporting and how both types of returns affect financial planning in different ways.”

Tip

Draw on your training to help you explain the differences between areas.

Questions About Problem-Solving

Every workplace runs into problems from time to time. Problem-solving questions help employers understand how you handle those moments. They show whether you’re able to stay calm, think things through, and find a practical way forward. From correcting accounting errors to handling tight deadlines, your answers can show both your initiative and your reliability.

Tell me about a time you found and fixed an accounting mistake.

Mistakes happen. Show how you will find them and fix them. Use this as an opportunity to talk about your attention to detail and how you take initiative when you spot an error. You can structure your answer using the STAR method (Situation, Task, Action, Result).

Sample Answer

Situation: “During my practicum, I was reviewing a set of payroll records.”

Task: “I noticed one employee’s overtime hours weren’t showing correctly in the system.”

Action: “I went through the timesheets, identified a data entry error, corrected it, and verified the totals with my supervisor before the pay run was finalized.”

Result: “The correction prevented a payroll error and reinforced my habit of checking details carefully.”

Tip

Focus on how you identified the issue and what you did to correct it.

How do you manage tight deadlines during month-end or tax season?

Month-end and tax season can get busy fast because businesses have a lot to close, review, and submit statements in a short amount of time. Interviewers want to hear how you stay organized and manage your work during those periods. This is a good chance to share the approach you rely on when there’s a lot on your plate. Here’s how the STAR method could apply.

Sample Answer

Situation: “During my practicum, I helped the accounting team prepare month-end reports with several deadlines approaching.”

Task: “I needed to stay organized and keep everything accurate while working under pressure.”

Action: “I priority-ranked my work, used a checklist to track progress, and communicated early with the team whenever something needed clarification.”

Result: “All reports were completed accurately and on time, and the experience taught me how planning ahead and teamwork make a big difference during busy periods.”

Tip

Describe specific strategies you used, like planning, teamwork, or communication.

Questions About Communication & Collaboration

Strong communication is essential in accounting, especially when explaining financial information to people who don’t share the same background. These questions show employers how clearly you express ideas, listen to others, and work with different teams to keep information accurate and projects on track.

How do you explain financial concepts to non-accounting staff?

In accounting, you’ll often work with people from areas like operations, marketing, or HR who don’t have a financial background. Show the interviewer that you can explain numbers in a way that makes sense to everyone, helping teams understand the bigger picture and work together effectively.

Sample Answer

“One example stands out comes from my practicum. During a month-end review, the operations team asked why expenses in one category were higher than usual. Instead of going into account codes, I walked them through the activities that actually drove those numbers. We reviewed vendor order volume, delivery timing, and a few one-time charges that landed in the same period.

Once the costs were linked to actions their team had taken, the discussion shifted from confusion to problem-solving. They adjusted their workflow for the next cycle. It reminded me how important it is to translate financial data into the day-to-day context of the team I’m working with.”

Tip

Show that you can adapt your communication style based on who you’re speaking with and focus on making financial information easy to understand.

How Sundance College Prepares You

The Accounting, Tax, and Payroll diploma program at Sundance College prepares you to manage financial records, process payroll, and handle tax reporting. Through practical training and a 5-week practicum, you develop technical accounting abilities and workplace experience: the combination that employers look for.

First, the coursework. You’ll learn to record and analyze transactions, prepare financial statements, calculate deductions, and complete personal income tax returns using accounting software like QuickBooks. Each course builds your understanding of bookkeeping, financial accounting, payroll, and tax preparation, helping you apply these skills in business environments.

The program also includes a practicum. This is where you’ll get a chance to apply all of your newfound knowledge and skills to real-world business scenarios. Now you’re job-ready.

Career Services support is available to help you find the job you’re looking for. The team provides help with resumes, interview preparation, and job search strategies.

The results speak for themselves. Accounting, Tax, and Payroll Graduate Sadia H. shared, “With support from Sundance College, I secured a full-time job at Talbot & Associates after my internship. The guidance I received from my instructors and Career Services made me feel supported every step of the way.”

Her experience shows that the right training and support can help you reach career goals.

To get started with your training, contact an admissions advisor today.

FAQs

-

How should I prepare for an accounting or payroll interview?

Review common interview questions and practice using the STAR method (Situation, Task, Action, Result) to structure your answers. Refresh your knowledge of bookkeeping, payroll systems, and tax preparation. Think about your experience and how you can relate each concept to something you’ve accomplished.

The right Accounting, Tax, and Payroll diploma helps you build these skills through hands-on training in QuickBooks, payroll systems, and tax reporting along with career support that includes mock interviews and job preparation. It will also include a practicum, which gives you experience that you can draw upon.

-

What questions should I ask the interviewer?

Ask questions that show interest in the workplace and awareness of accounting procedures, such as:

- What accounting or payroll software does the company use?

- What are the team’s priorities during month-end or tax season?

- What qualities make someone successful in this role?

These questions reflect your understanding of accounting operations and your enthusiasm to learn.

-

How can I show experience as a new graduate?

Use examples from your diploma program and practicum to demonstrate readiness. Highlight hands-on experience with QuickBooks, payroll processing, and tax preparation, and explain how you applied accounting principles to workplace situations.

-

What’s the average starting salary in payroll or accounting roles?

Entry-level positions such as payroll administrator, accounting assistant, or bookkeeper offer competitive salaries up to $61,755 per year, depending on province, experience, and company size.

-

What soft skills help stand out in interviews?

Employers value communication, organization, and time management in accounting and payroll roles. They also look for reliability, professionalism, and the ability to handle financial information accurately while collaborating with others.

-

How soon can I start working after graduation?

In the right diploma program, with hands-on training, practicum experience and individualized resume, interview and job search support, you will begin working shortly after graduation. At Sundance College, 92% of Accounting, Tax & Payroll diploma graduates are working in their field within 6 months of completing their program.

Related Blogs

Subscribe for more career advice

Blog Categories

Share on: