Blog / Budgeting for College Students in 5 Easy Steps

Budgeting for College Students in 5 Easy Steps

Explore our Diploma Programs

- Business, Hospitality, and Legal

- Health and Human Services

- Technology

Table of Contents

Are you a college Student? Do you often find yourself worrying about finances – and feeling as if the bills come in faster than the paycheques? You can relieve some of that stress, and take more control over your finances, by planning and using a budget.

Budgets are essential for managing your money. Whether you’re new to organizing your finances or have struggled to do so successfully in the past, the tips below will simplify the process of building a budget and help you achieve financial stability as a college student and after you graduate.

What is the Purpose of a Budget?

The purpose of a budget is to, essentially, make a plan for your money. By offering a big-picture view of your finances, it equips you to make informed spending and saving decisions. In other words, budgeting ensures that you will always have enough money for the things you need and, perhaps, the things you want too!

Following a budget can also help you reduce debt, something that is especially important for students, who often rely on loans to fund their education.

How to Create a Budget

1. Determine Your Financial Goals

Your financial goals will guide your decisions about how to spend (or save) your money. Common financial goals for college students include:

- Paying off a student loan as quickly as possible

- Staying on top of bills while working part time

- Building up savings to stay financially stable after graduation

Whatever your financial goal is, imagine how great you’ll feel once it’s met! Use this image as motivation for sticking with your budget.

2. Analyze Your Spending Habits

Before you can create a plan for your money, you need to know how much money is coming and going from your bank account.

Start by recording your monthly income, recurring monthly expenses (like your rent and phone bill), and any outstanding debt. Then, subtract your expenses from your income. The remaining figure is the money available after your main living expenses have been paid, also known as your disposable income.

An even better way to determine where your money is going is to track everything you spend for one month. From the smallest expense to the largest, write it all down in a notebook or spreadsheet on your computer. You might be surprised when you look at your habits, even after just a couple of weeks.

3. Differentiate Needs From Wants

Once you’ve recorded your monthly expenses, divide your spending habits into two categories: ‘needs’ and ‘wants.’ A spending ‘need’ is something that is absolutely necessary for your well-being and survival, such as rent or mortgage payments, food, and utility bills. A spending ‘want’ is something you would like to have or experience but do not require, such as dining out, entertainment, or traveling.

By identifying how much of your money goes to ‘needs’ vs. ‘wants,’ you may discover ways to adjust your habits and better support your financial goals.

4. Choose A Budgeting System Or App

Budgeting systems are designed to help you understand and shape your relationship with money. While there are many different methods to choose from, some are more popular among students than others. Here are two that work well if you are paying off a student loan and/or saving for the future:

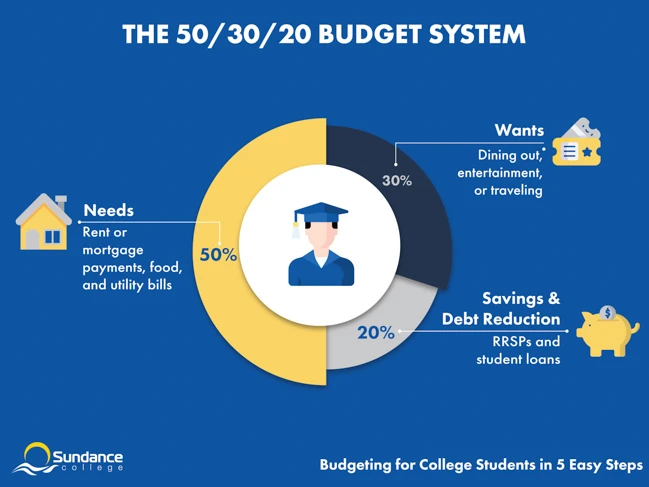

50/30/20 Budget System

A popular budgeting method is called the 50/30/20 Budget System. It sets easy-to-follow guidelines for how to plan your budget, allocating:

- 50% of your after-tax income for ‘needs’

- 30% for ‘wants’

- 20% for savings and debt reduction

Pay Yourself First

Another commonly used budgeting system for students is the Pay Yourself First method. This method prioritizes saving and instructs you to transfer a pre-determined amount into savings at the beginning of each month. After you contribute to your savings, you should pay your bills, then use the rest for discretionary spending.

Budgeting apps are also popular among students and help to analyze your habits and implement a budgeting system. Some of the leading budgeting apps include:

5. Track Your Budget Progress

Some expenses vary from month to month; you could require a surprise vehicle repair or need to hire a babysitter. Income can change as well, depending on your work schedule.

Revisiting your budget once a month allows you to deal with spending or income fluctuations as they occur.

As you track your budget, remember to celebrate your successes! Every adjustment – whether you’ve reduced spending on unused subscriptions or introduced debt reduction to your budget – counts toward your larger goal.

Budget for Your Future

It’s never too early to start working toward your financial goals. Building a budget as a college student can reduce stress while you study and prepare you for financial stability after graduation.

Be sure to explore the financial resources and supports available to you while you’re in school. At Sundance College, our student financial administrators guide students through the student loans and grants process, so they feel well-equipped to enter the workforce with a firm grasp on their financial situation.

Budgeting isn’t the only way to improve your finances. Did you know higher education can increase your earning potential by an average of 18%? If you’re considering a career change, click here to speak to an advisor about pursuing a career-focused diploma at Sundance College.

Subscribe for more career advice

Blog Categories

Share on: