Blog / 5 Key Skills for a Career in Finance

5 Key Skills for a Career in Finance

Accounting, Tax, and Payroll Diploma

- Accounting Assistant/Technician

- Bookkeeper

- Income Tax Return Preparer

- Payroll Administrator

Table of Contents

Is Finance a Good Career Path?

Happy Financial Literacy Month! We thought this would be the perfect time to discuss working in finance – and explain how you can start on a career path with plenty of opportunity for growth. For a closer look at the reasons finance makes a great career choice, have a look at Why Choose an Accounting, Tax, or Payroll Career.

Businesses of every size and sector need a finance team, which means roles related to accounting, tax, and payroll are in demand. Even better, finance professionals tend to be highly sought after regardless of market conditions. If making a measurable impact on the future of an organization is important to you, finance could be an excellent career option.

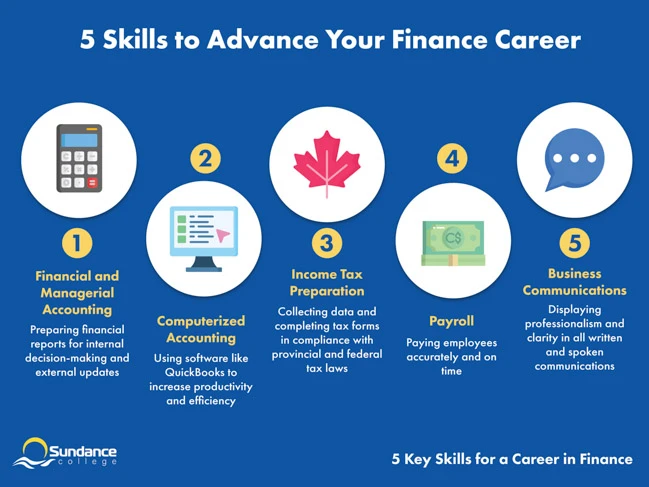

Roger, one of our Accounting, Tax and Payroll instructors, has identified 5 key skills for a career in finance. By entering the workforce with those finance skills, you’ll increase your opportunities for employment and advancement. Let’s explore what they are and how these valuable skillsets can jumpstart your finance career!

1. Financial Accounting

Financial accounting is involved in reporting on a company’s finances. This function typically focuses on updating external parties, like investors, on how a business is performing. This type of accounting involves creating financial accounting reports that adhere to a set of official standards. Financial accounting prepares data for review so everyone can stay informed.

2. Computerized Accounting

Accounting software makes it easier to perform essential functions and keep data organized. Programs like QuickBooks make accounting, invoicing, payments and reporting much more efficient.

Having a theoretical understanding of how QuickBooks works is a start – but nothing beats hands-on experience. Knowing the ins and outs of computerized accounting software will prepare you for important daily tasks right from the start.

3. Income Tax Preparation

As the saying goes, taxes are one of life’s few certainties. Understanding how to prepare and file personal income tax is a crucial skill in the finance industry – and could even be a means of making supplemental income during tax season!

We pay provincial and federal taxes to the Canada Revenue Agency. The amount we pay in taxes is based on our income – which is why we file a tax return annually to report how much we’ve made. The government also offers benefits in the form of tax credits, which can reduce how much we’re required to pay.

Some tax returns are simple and straight forward. But many returns involve complexities that require the expertise of someone with in-depth knowledge and experience. Filing income tax involves collecting relevant data, completing tax forms, and complying with tax laws to maximize returns for your client. If you are well-versed in taxes, you may be able to support your organization with their tax preparation as part of an accounting role. Or you may choose to work in the tax industry full time as an Income Tax Preparer.

4. How to Do Payroll

Did you know that in Canada, payroll professionals have an annual GDP impact of $7.9 billion? In other words, payroll operations are integral to the national economy at large – they ensure salaries are paid and taxes are deducted appropriately.

Everyone loves payday, but let’s not forget the work that goes paying employees accurately and on time. Payroll involves tracking hours worked and managing payroll deductions, as well as navigating payroll software and keeping accurate reports.

These skills are vital to operations at any organization – and crucial for supporting employee well-being.

5. Business Communications

Numbers are important for any finance professional – but strong communication skills are also vital. This includes the way you engage with your co-workers, write reports, and present at meetings. Here are just a few business communication skills that will help you get ahead in your finance career:

Writing

Any role you fill in financial services will require you to write at least a little, whether that’s in the form of business emails, meeting agendas, or financial reports. Strong writing skills demonstrate professionalism and indicate that you care about your work (typos and spelling errors aren’t a great look). Well-written emails and reports also streamline processes by ensuring everyone is on the same page and has the information they need. If a report is unclear and disorganized, vital information could be lost.

Presenting

Have you ever been motivated by a TEDTalk or even a classroom lecture?

The speaker was likely able to keep calm under pressure, speak clearly, and properly articulate their thoughts. Skilled presenters also know how to organize information visually for the greatest impact.

If you want to stand out in meetings – and job interviews – we highly recommend working on your presentation skills. The very best presenters come across as confident and competent and inspire action in others.

Collaborating

Any financial role will likely require working with other departments like HR, sales, and product. Being able to listen actively, incorporate feedback, and communicate with empathy are essential workplace skills. When you’re great at collaborating, people want to work with you, helping you get ahead in the long run.

What Are Some Accounting and Finance Jobs in Canada?

The more tools you have in your toolbox, the better prepared you’ll be to fulfill many kinds of financial roles. You may even find yourself in a position that wears multiple hats, especially if you’re working for a small business.

Here are just some of the accounting and finance jobs in Canada you could apply for with the skills we’ve listed (and which don’t require a bachelor’s degree):

Accounting Technician

This role usually supports an Accountant by completing tasks like payroll, managing financial statements and records, and submitting tax forms.

Payroll Administrator

We’ve already mentioned how important payroll is for business operations – and Payroll Administrators make the magic happen. Knowing how payroll service works is obviously central to this role, but accounting and tax skills are also important.

Office Coordinator

This role streamlines overall office operations, so understanding a range of roles – from accounting to payroll – is paramount. Office Coordinators can work in all types of offices, including legal firms, schools, and insurance companies.

How to Start Your Career in Finance

Prepare for a successful finance career with the Commerce: Accounting, Tax, and Payroll Diploma Program at Sundance College. Taught by industry professionals, the CATP program equips you with expertise in each skill we’ve outlined, setting you apart as a well-rounded professional.

In addition, our program includes practicum experience at a business firm and essential Career Services supports, including resume preparation and role-playing to prepare you for interviews.

Visit our website to learn more about our Commerce programs and fill out this form to make the first move toward your dream role.

Related Blogs

Subscribe for more career advice

Blog Categories

Share on: