Blog / How to Become a Payroll Administrator

How to Become a Payroll Administrator

Accounting, Tax, and Payroll Diploma

- Accounting Assistant/Technician

- Bookkeeper

- Income Tax Return Preparer

- Payroll Administrator

Table of Contents

Payday – it’s the day we all eagerly await when our hard work turns into those well-earned dollars. But who makes sure every cent you’ve earned gets paid correctly and on time? That’s the role of payroll administrators!

These administrators in the payroll department are responsible for processing employee payments, calculating deductions, and maintaining compliance with tax laws and regulations. Thanks to their precision, you can enjoy peace of mind knowing you’ll get exactly what you’re owed, with no surprises.

If you enjoy working with numbers and want a structured role that mixes finance with daily administrative tasks, you can join their ranks, too. In fact, if you’re wondering whether a career in payroll is a good fit for you, read the inspiring story of one of our graduates who made a successful transition into the field.

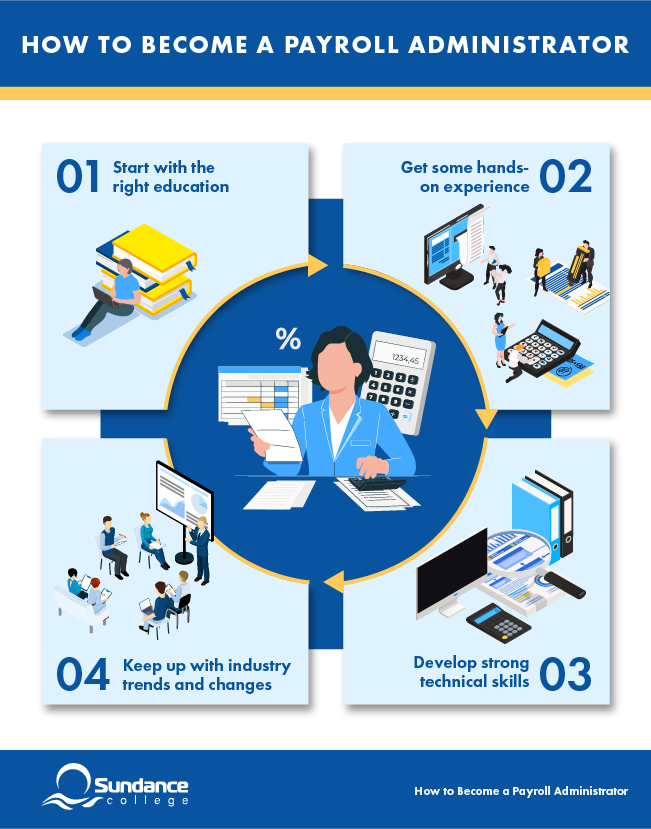

Here’s how to get your own career in payroll started:

Listen to: How to Become a Payroll Administrator in Canada

How to Get Started in Payroll Administration

Start with the Right Education

First, you’re going to need a solid foundation. That means the right training in accounting, tax, and payroll.

Most payroll administrators start with a diploma in payroll administration or a related field such as accounting or finance. In Canada, institutions like Sundance College offer diploma programs specifically tailored to accounting, tax, and payroll professionals. When selecting a program, make sure it covers essential areas such as payroll legislation, accounting principles, and payroll software.

Sundance College’s career-focused Commerce: Accounting, Tax & Payroll (CATP) program provides students with the fundamental knowledge and skills required for employment in the payroll field. Courses in the program include:

- Financial Accounting: In this course, you’ll learn how to prepare financial statements, including income statements, balance sheets, and managing short and long-term assets, liabilities, and shareholders’ equity using Generally Accepted Accounting Principles (GAAP).

- Payroll: In this course, you’ll develop a thorough understanding of payroll legislation in Canada, the framework for accurately paying employees, and handling employer and employee remittances to the Canada Revenue Agency. This knowledge ensures compliance and efficiency in payroll management.

These courses, as well as the rest of the courses on our program prepare you for a career as a payroll administrator by providing necessary skills in financial accounting, payroll processing, and compliance.

By mastering these areas, you’ll be ready to handle complex payroll operations and contribute to the financial success of any organization.

Get Some Hands-On Experience

Education is important, and so is real-world experience. To bridge the gap between theoretical knowledge and practical application, take advantage of the practicum experience provided by your diploma program.

Real-world training can expose you to the entire payroll process, from accurately processing payrolls to understanding and complying with complex tax regulations. This practical experience not only reinforces your academic knowledge but also improves your problem-solving skills and adaptability in the workplace.

Just ask Sadia H., a Sundance College graduate who knows firsthand how valuable this experience can be:

“Sundance facilitated my practicum and during my internship I received a full-time job offer. Now, I’m working at Talbot & Associates. It was a life-changing experience.”

Your diploma and practicum experience position you for a career as a Payroll Administrator. For additional ways to broaden your skills and connections, consider volunteering for payroll tasks at local non-profits or small businesses. Volunteering offers a dual benefit: it provides you with practical experience while contributing to your community.

By gaining hands-on experience in diverse areas, such as applying payroll legislation, payroll software, and remittances to the Canada Revenue Agency, you will become a more competitive candidate when applying for payroll administration roles and better prepared for the responsibilities that come with the job.

Develop Strong Technical Skills

Payroll administrators need many skills, and being familiar with payroll technology is one of them. In today’s digital age, being tech-savvy is essential for payroll administrators. Proficiency with various Canadian payroll systems and tools is a must.

Start by familiarizing yourself with popular payroll systems like QuickBooks; efficient use of this system will streamline your work and significantly reduce the risk of errors. Additionally, honing your skills in Excel and other data management tools is also beneficial for handling complex payroll calculations and performing detailed data analysis.

Within the Commerce: Accounting, Tax & Payroll (CATP) program, you will gain the technical knowledge you need through comprehensive, career-focused courses, including:

- Computerized Bookkeeping (QuickBooks): Transition from manual bookkeeping to computerized accounting programs, gaining a thorough understanding of QuickBooks to manage payroll and accounting tasks.

- Microsoft Excel: Learn to organize spreadsheets, utilize functions, and create equations. Excel proficiency will enable you to handle complex payroll calculations and perform detailed data analysis with ease.

- Microsoft Word and Outlook: Learn to create and format documents in Word and manage emails effectively in Outlook. These skills are essential for maintaining accurate records and efficient communication within the workplace.

These courses will help you develop the strong technical skills necessary for being successful in payroll administration. As Carmila De La Rosa, a graduate of our CATP program, shared, “The Excel course was incredibly valuable. The skills I gained have made a big difference in my current job.”

By being proficient in these tools, you will be well-equipped to handle the demands of your payroll job.

Keep Up with Industry Trends and Changes

The payroll administration field is constantly evolving, driven by new technologies including cloud-based payroll systems, automation and artificial intelligence.

To stay ahead, it’s important to engage in continuous learning and professional development. There are various ways to stay updated, like subscribing to industry newsletters and following relevant blogs. Other ways to stay up to date with the latest industry trends include:

Workshops and Seminars: Participate in industry events to learn about the latest trends and regulatory changes. These gatherings provide invaluable opportunities for networking and professional growth.

Online Learning: Enroll in online programs tailored for payroll administrators to maintain and enhance your skills. These resources offer flexible learning options to fit your schedule while ensuring you stay proficient in the latest tools and best practices.

By staying updated on the latest technologies, you will help you become more effective in your role and increase your value at your organization. This proactive approach to professional development will help you navigate the evolving landscape of payroll administration and pave out a long and fulfilling career.

Ready to Start Your Career in Payroll Administration?

Entering the field of payroll administration is a rewarding journey that requires both a solid education and technical proficiencies. As you build your skills and keep up with industry changes, remember that every step you take brings you closer to a career that ensures the financial well-being of organizations and their employees. Whether you’re just starting out or continuing to grow, staying informed and adaptable will help you succeed.

If you’re ready to take the next step, connect with one of our admissions advisors today. They can guide you through the process, answer any questions, and set you on the path to success.

Related Blogs

Subscribe for more career advice

Blog Categories

Share on: